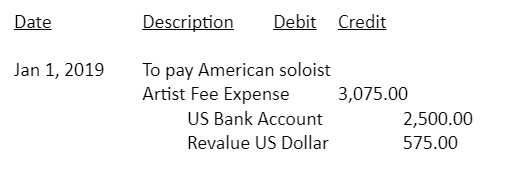

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

What Is an Accountant?

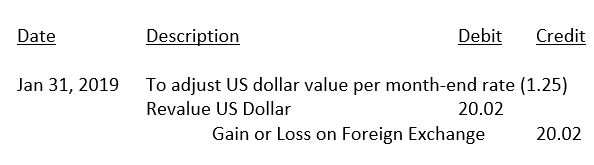

What is the journal entry to record a foreign exchange transaction

Advanced Accounting Foreign Currency Transactions

FINANCIAL ACCOUNTING FINAL EXAM

FINANCIAL ACCOUNTING FINAL EXAM

How do I record a US$ or other foreign currency transaction? — Young Associates

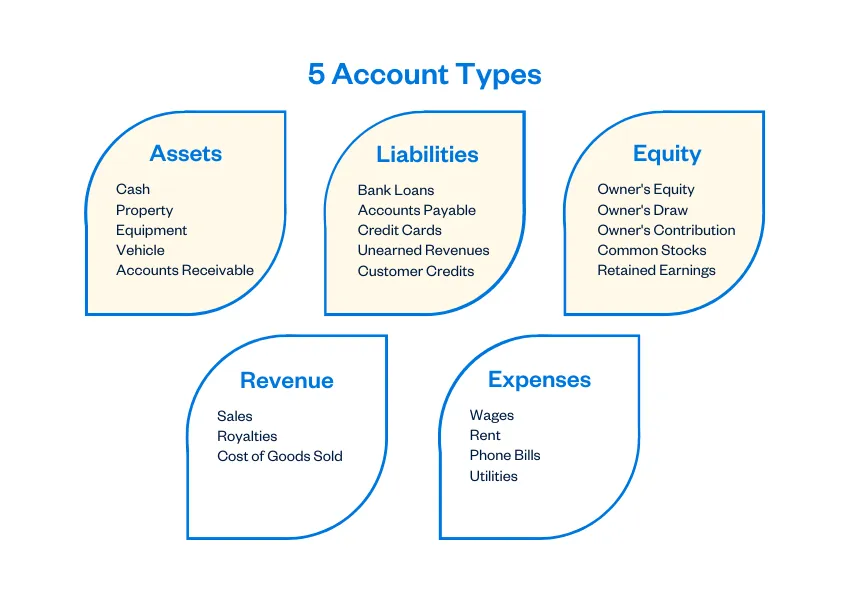

5 Different Types of Accounts in Accounting

The 15 Best Free Online Accounting Courses - MBA Central

Cfas 2020 Ed Answer Key, PDF, Accounting

What is the journal entry to record an unrealized gain on an

How do I record a US$ or other foreign currency transaction

formdrsa_001.jpg

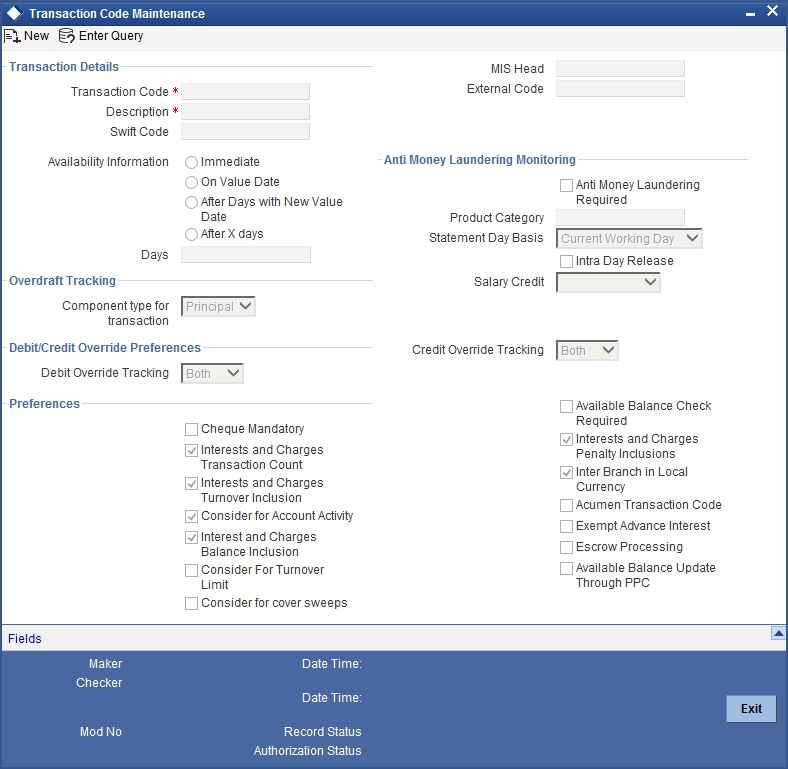

21. Transaction Code