How Senior Citizens Can Save Tax With Medical Bills U/S 80D? – Policy Ghar

Mediclaim Deduction Under Section 80d For Senior Citizens - Design

Claim 80D deduction on medical expenses, Income Tax Act

SR Associates - Section 80D -------------------- Deduction u/s 80D on health insurance premium is Rs 25,000. For Senior Citizens it is Rs 30,000. For very senior citizen above the age of 80

Union Budget 2022: Why Budget 2022 should allow tax deduction for expenditure on Covid treatment - The Economic Times

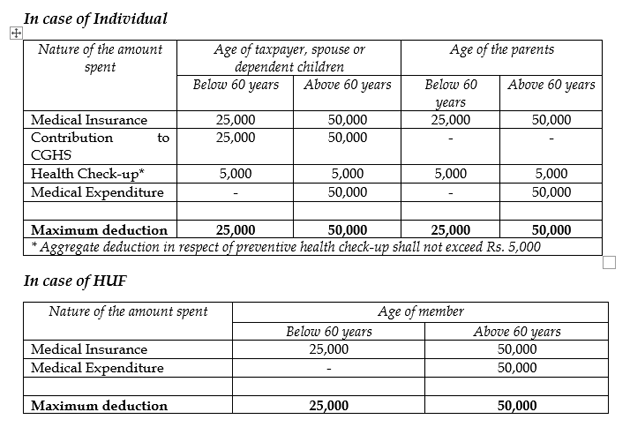

What is Section 80D of Income Tax - Deduction for Medical & Health

Section 80D : Deduction for Medical Insurance & Health Checkups 2019

TaxBuddy.com on LinkedIn: Here's how senior citizen (60+) / super-senior citizens (80+) can save ₹…

How Senior Citizens can save Tax with Medical Bills u/s 80 D?

Section 80D Deduction against Health Insurance for Senior Citizens

)