Andorra offers favourable taxation regimes for individuals and companies. The income tax applies only to the annual amount exceeding €24,000. The corporate tax rate is 10%, and the VAT is 4.5%. Learn more about the effective rates, exemptions and how to become a tax resident of Andorra.

Tax advantages of Andorra - Optimize your taxes

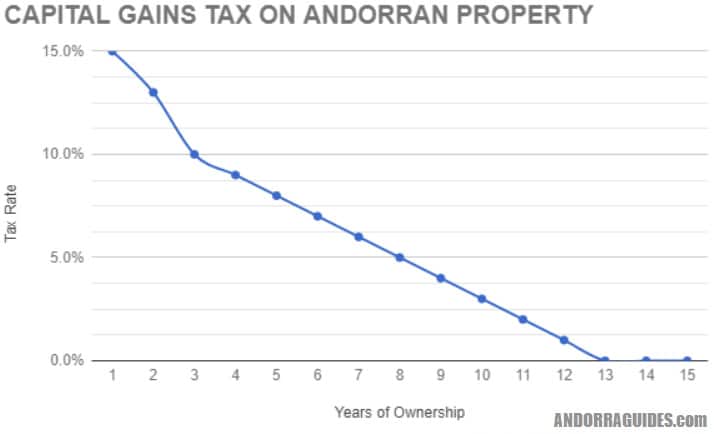

Capital Gains Tax in Andorra

Andorran tax benefits

List of countries by tax rates - Wikipedia

Digital Taxes Around The World

All about Andorra Tax System

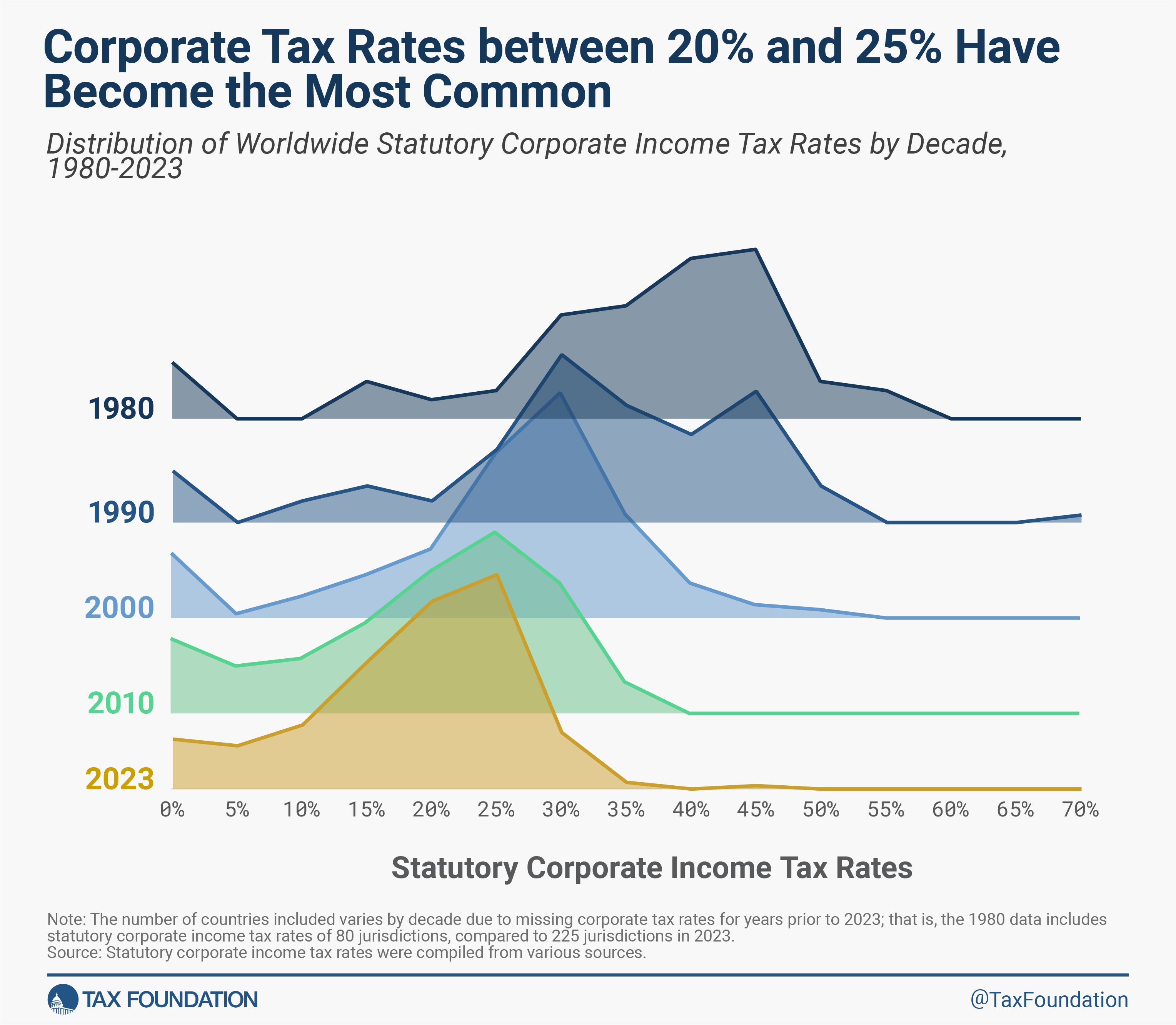

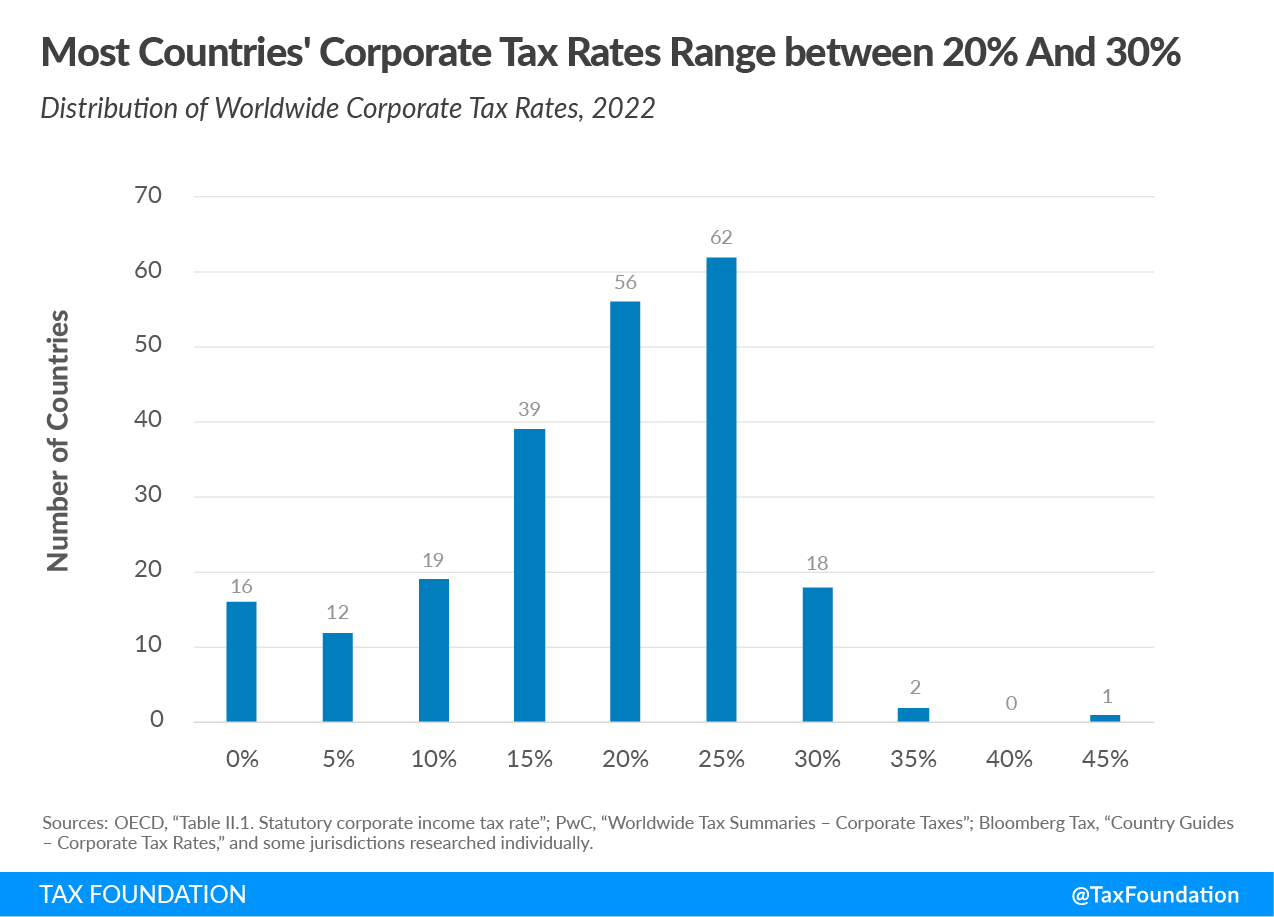

Corporate Tax Rates around the World, 2023

a.storyblok.com/f/176292/1536x864/d9db9258ee/resid

How Small Businesses Are Taxed in Every Country

Taxes in Andorra: how to get a residence permit and become a tax resident

European Union Andorra Income Tax Flat, PDF, Tax Haven

How to Set Up an Offshore Company in Andorra

Corporate Tax Rates by Country, Corporate Tax Trends