The Internal Revenue Service extends a special credit to older taxpayers called the Credit for the Elderly or the Disabled. This tax break allows individuals and couples to reduce the amount of their income tax by their allowable credit. While a taxpayer may qualify for a larger credit under this provision, the IRS limits the allowable credit to the amount of income tax due. If your credit exceeds your income tax, you will not be able to receive the excess credit as a refund.

Tax Counseling for Seniors and the Elderly - TurboTax Tax Tips

Do I Pay Taxes On A Personal Injury Settlement? Morris, 59% OFF

TurboTax Offers 7 Tax Tips for After You Retire - TheStreet

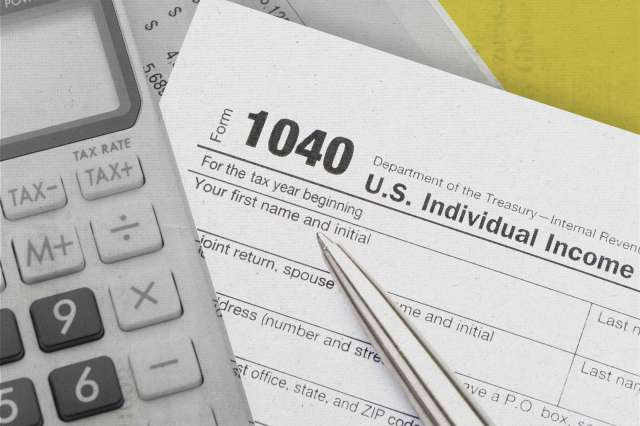

IRS tax forms - Wikipedia

TurboTax® Basic Desktop 2023-2024

Form 1040 U.S. Individual Income Tax Return for Sally W. Emanual for tax year 2008, PDF, Tax Refund

Tax return

TurboTax Deluxe Federal + eFile + State 2009 : Everything Else

imgv2-1-f.scribdassets.com/img/document/553843024/

YAMI, PDF, Tax Refund

TurboTax® Basic Desktop 2023-2024

Do I Pay Taxes On A Personal Injury Settlement? Morris, 59% OFF