The Low Income Housing Tax Credit (LIHTC) program was created in 1986 and is the largest source of new affordable housing in the United States. There are about 2,000,000 tax credit units today and this number continues to grow by an estimated 100,000 annually. The program is administered by the Internal Revenue Service (IRS). The […]

Low-Income Housing Tax Credits, NSP LLP

Affordable housing developments in Edgewater, West Pullman among those awarded low-income housing tax credits : r/EdgewaterRogersPark

Low-Income Housing Tax Credits: Why They Matter, How They Work and

Low-Income Housing Tax Credit (LIHTC) Overview

The American Jobs Plan Would Mean Major LIHTC Expansion

The American Jobs Plan Would Mean Major LIHTC Expansion

G.A. Haan Development - Low-Income Housing Tax Credits The Low-Income Housing Tax Credit (LIHTC) is the most important resource for creating affordable housing in the United States today. The LIHTC database, created

Ohio Housing Finance Agency Awards Low Income Housing Tax Credits to Lucas Housing Services Corporation (05/19/2022) - News - Lucas Metropolitan Housing, Toledo, OH

Housing Readiness Fact Sheet: Low-Income Housing Tax Credits

/portal/sites/default/files/images/

Low-Income Housing Tax Credit (LIHTC)

The Low-Income Housing Tax Credit: Elements and Oversight Issues (Housing Issues, Laws and Programs): Daniels, Yvette: 9781634845694: : Books

Low-Income Housing Tax Credits

Housing & Neighborhood Revitalization Low Income Housing Tax Credits

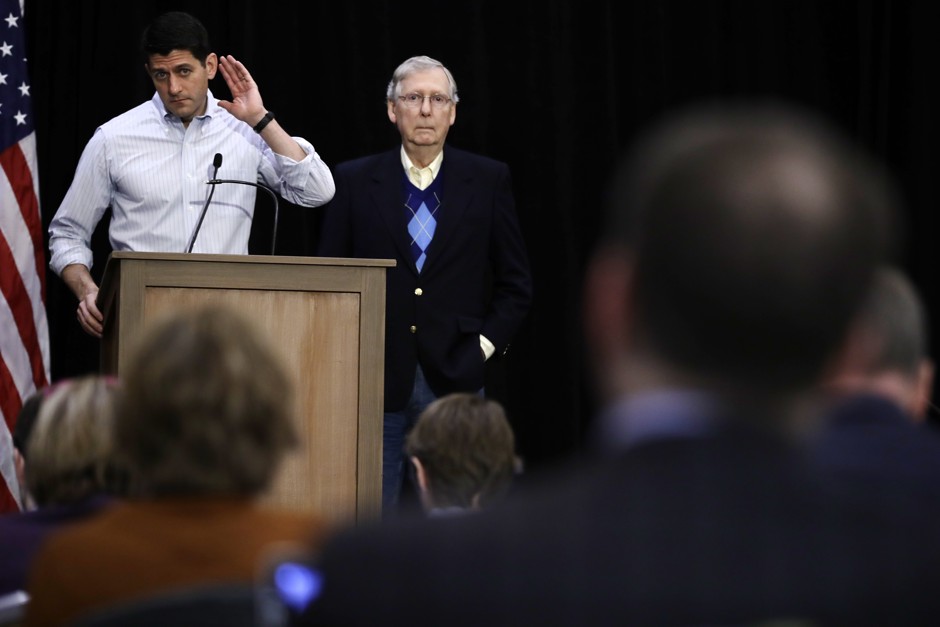

Investors Pause on Low Income Housing Tax Credits as Tax Reform Looms - Bloomberg