Advanced Energy Project Credit

Renewable Energy & Advanced Energy Project Investment Tax Credits: What You Need To Know

DOE allots $1.6 billion to decarbonize coal country

July 31st deadline for $4 Billion in Inflation Reduction Act Funds for Green Manufacturing

Qualifying Advanced Energy Project Credit (48C) Program

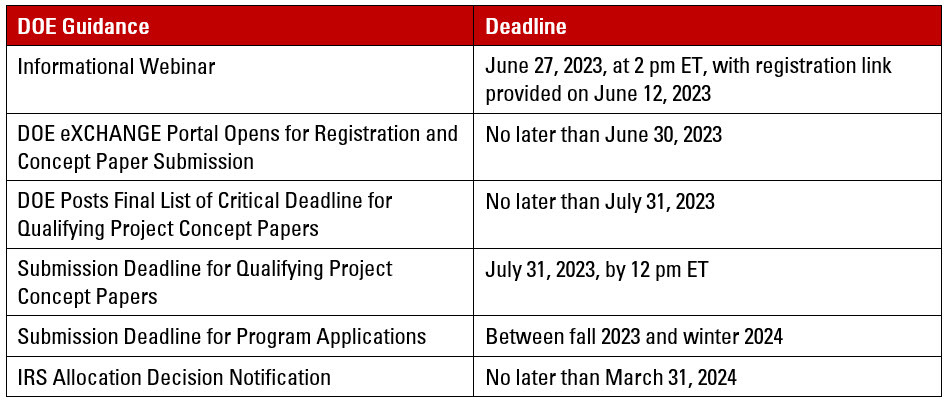

Additional Guidance Issued Related to IRC §48C(e) Credit

Section 48C energy credit application process unveiled

Avi Shultz on LinkedIn: DOE just announced billions in tax credits and funding that could have…

Treasury Department and IRS Release Additional Guidance for the Advanced Energy Project Credit Allocation Program

How To Take Advantage Of 48C - Tri-Merit

Treasury Announces Guidance and Timetable for Qualifying Advanced Energy Project Credits

Treasury, IRS provide guidance on advanced energy credits

Is Your Manufacturing Company Eligible for Clean Energy Tax Credits?

IRS Clarifies the 48C Program Application Process and Timeline

EnergyCommunities on X: Save the date! Join the @ENERGY's MESC and the IWG for several regional events this month focused on the Inflation Reduction Act's $10 billion Qualifying Advanced Energy Project Credit (