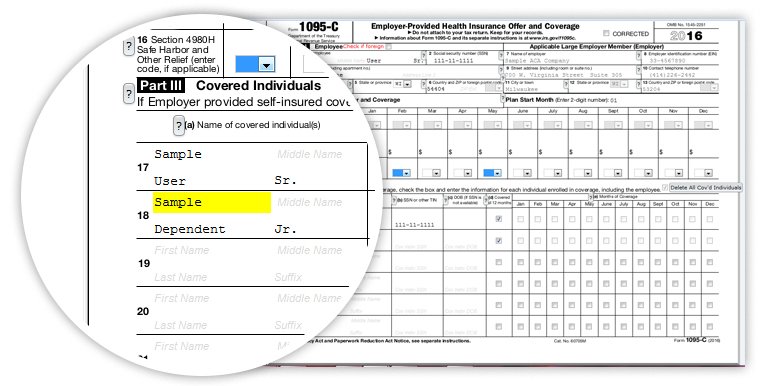

Employers may become overwhelmed by health insurance paperwork and reporting responsibilities. Under the Affordable Care Act (ACA), the IRS requires all applicable employers and qualified health plan providers to report information about their health plans and health coverage enrollment using tax Forms 1095 A, B, and C. However, there are different requirements for each of these documents.

Which ACA Form 1095 Applies to My Business? 1095-B VS. 1095-C

1095 FAQs Human Resources

1094 / 1095 Forms - ftwilliam.com

-0001.png)

IRS Form 1095 & Form FTB 3895 and your health insurance subsidy

Is a Safe Harbor 401(k) Right for You?

View All Paychex WORX Employee Benefits Resources

What is a Consumer-Driven Health Plan?

1095 Form When to Use the A, B, or C Forms

1095-B Software $599

IRS Issues Final Regulations Regarding Form 1095 ACA Reporting Requirements

Difference Between Gross vs. Net Income and Pay

What Is HR Analytics & How Can It Help?

:max_bytes(150000):strip_icc()/imageedit_4_7778438120-f5a8a7aac0fd466ab91af5b4d29ebf6e.jpg)

Form 1095-B: Health Coverage: What it is, How it Works

What Is Cyber Liability Insurance & Why Is It Important?

/skechers-kamizelka-goshield-everyday-vest-ja7-czarny-regular-fit-0000303298876.jpg)